Indicators on Business Consulting Okc You Need To Know

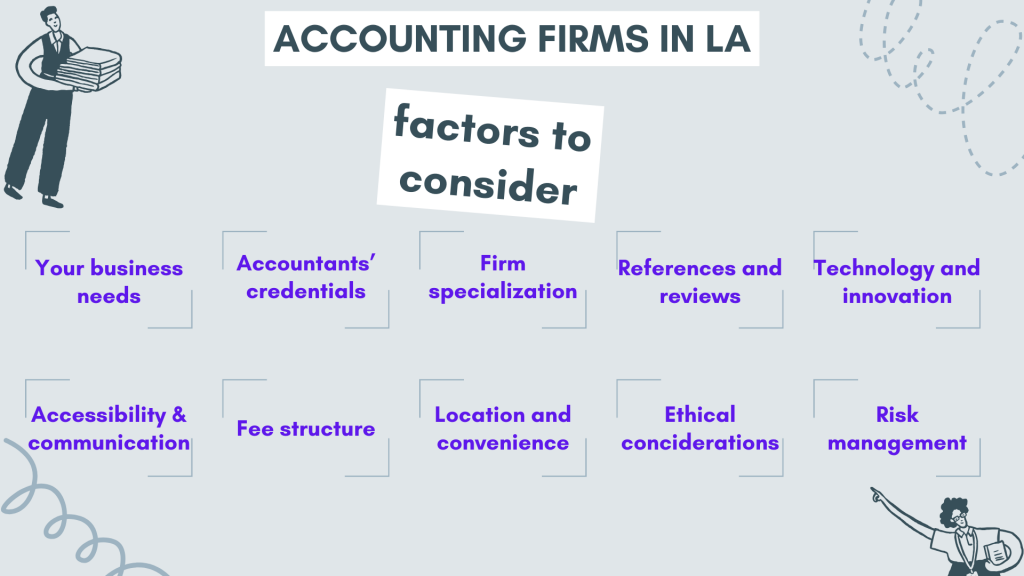

Table of Content As an entrepreneur, you understand that having a reputable and credible accounting firm is of your company. With so numerous from, how do you understand which one is ideal for you? The first step is to specify your business needs. What services do you need from an accounting firm? Do you need assist with bookkeeping, tax preparation, or financial planning? When you know what services you require, you can start to narrow down your options.

Read online reviews, talk with other organization owners, and get recommendations from people you trust. This will help you get a feel for each company's credibility and. Once you've narrowed down your options, it's time to start meeting prospective firms. During these conferences, make sure to ask great deals of questions.

After meeting with numerous companies, you need to have an excellent sense of which one is the.

The Ultimate Guide To Real Estate Bookkeeping Okc

Do not rush into a decision - take your time and discover the best fit for your company. As a business owner, it is crucial to partner with an accounting company that can offer extensive services and recommendations.

Define your needs. Before you start your search for an accounting company, it is back and evaluate your requirements. What services do you require? What type of suggestions are you trying to find? What are your objectives? When you have a of your needs, you will have the ability to limit your search and discover firms that are a.

Do your research. When you know what you are searching for, it is time to begin your research study. Look for firms that have experience serving. Ask for referrals from relied on. https://hubpages.com/@p3accounting. And, most notably, read online evaluations. This will provide you a common sense of a firms reputation and whether or not they are likely to fulfill your needs.

After you have actually narrowed down your list of potential firms, it is time to set up consultations. This is your chance to fulfill with the companies agents, ask questions, and get a feel for their culture and values.

Get everything in writing. Before you make a final choice, make certain to get everything in writing. This consists of the scope of services, the fees, and the timeline. This will assist avoid any misconceptions down the road and will give you something to refer back to if there are ever any issues.

Facts About Okc Tax Credits Revealed

In this case, a smaller sized accounting firm might be a better fit. They'll be able to offer the individual attention and grow.

The 3-Minute Rule for Okc Tax Credits

No matter what size company you have, it is very important to find an accounting firm that's a good fit. Make the effort to examine your needs and pick a company that can supply the level of service and support you require to succeed. When you are searching for an accounting firm, it is crucial to think about the place of the firm.

You require to discover an accounting firm that lies in a place that is practical for you and your staff members. If you have a business that is based in the United States, you should think about an accounting firm that lies in the United States. This will make it simpler for you to interact with the accounting company and to get the services that you need.

This will make it much easier for you to get the services that you need and to communicate with the accounting firm. taxes OKC. It is also crucial to consider the size of the accounting company. You require to discover an accounting company that is big enough to manage your accountancy needs, but not so big that it will be tough for you to communicate with the accounting firm

The Best Guide To Tax Accountant Okc

When you are looking for an accounting company, you ought to likewise think about the credibility of the accounting company. You require to discover an accounting firm that has a good reputation in the industry. You can find this info image source by asking other organizations in your market about their experiences with various accounting companies.

You need to consider the charges that the accounting firm charges. You can find this details by asking other businesses in your market about their experiences with different accounting companies.

Bookkeeping Okc Can Be Fun For Anyone

Make sure the company offers the services you need. How much experience does the company have? Bureau or other websites.

What is the firm's geographic reach? If you have businesses in multiple states, you'll require an accounting company that can handle your taxes in all those states. What is the company's size? A large company may have more resources, but a smaller sized firm may be more responsive to your requirements.